By Randy Mascagni, MBA, CFP

It’s the same old dilemma. Take too much risk with your investments in the hope of higher earnings and you could wind up with less money than you had when you started out. Take too little risk and you might not reach your investing goals.

And then there’s the fear factor. Some people panic over small losses, while others are willing to wait out any short-term decline in the value of their investments for the potential to earn higher returns over the long term. Your ability to tolerate risk influences your investment choices and may affect your success in reaching your goals. It’s important to understand your tolerance for risk so you can choose the right combination of stocks, bonds, and cash for your portfolio.

Naming Names

Your risk “comfort level” defines the type of investor you are. Most investors fall into one of three broad categories.

Conservative investors seek to preserve principal and avoid even short-term losses. If you’re in this category, you’re willing to accept earning lower returns as long as they outpace inflation. Your portfolio generally holds fixed income and cash investments, with only a small portion devoted to stocks.

Moderate investors are willing to accept some risk of short-term losses in exchange for the potential to earn higher returns. As a moderate investor, your portfolio typically consists of a mix of stocks, bonds, and cash investments.

Aggressive investors are willing to accept the risk of short-term losses in return for the potential to maximize earnings. With an aggressive approach, your portfolio usually will be heavily weighted in stock investments. A long time frame before you’ll need your savings may allow you to take more risk with your investments.

Your Feelings and Then Some

Your feelings about investment risk aren’t the only things you’ll want to consider. Your job and income security, your emergency savings, and even your marital status should all factor into your investment decisions. And remember that the amount of risk you feel comfortable taking probably will change as you get closer to the time when you’ll need your money.

Not Sure?

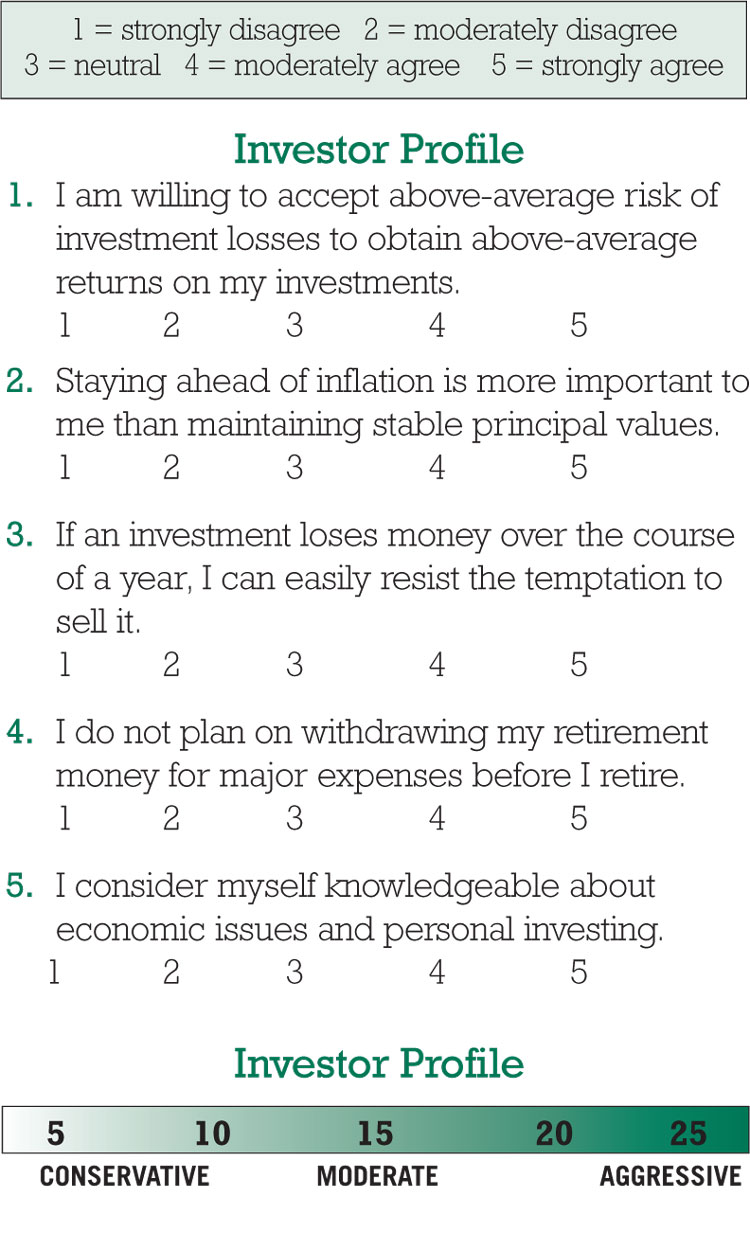

The questionnaire below can help you determine your risk tolerance. Rank yourself on the scale from one to five according to how strongly you agree or disagree with each statement. Then add up the numbers to find out where you fall on the Investor Profile. The questionnaire can help you understand your objectives and feelings about risk so you can select investments that are right for you.

Loose Change Newsletter, Vol. 22, No. 6 provided by Randy Mascagni, MBA, CFP®, President, Mascagni Wealth Management.